Además, los CFD y Forex utilizan gráficas y métodos de valuación muy parecidos. El trading de CFD y Forex se hace por medio de medios electrónicos completamente, sin realizar intercambios físicos.

Por último, participar en el mercado de CFD o Forex no implica el pago de comisiones ni cuotas de manejo, simplemente se paga el spread.

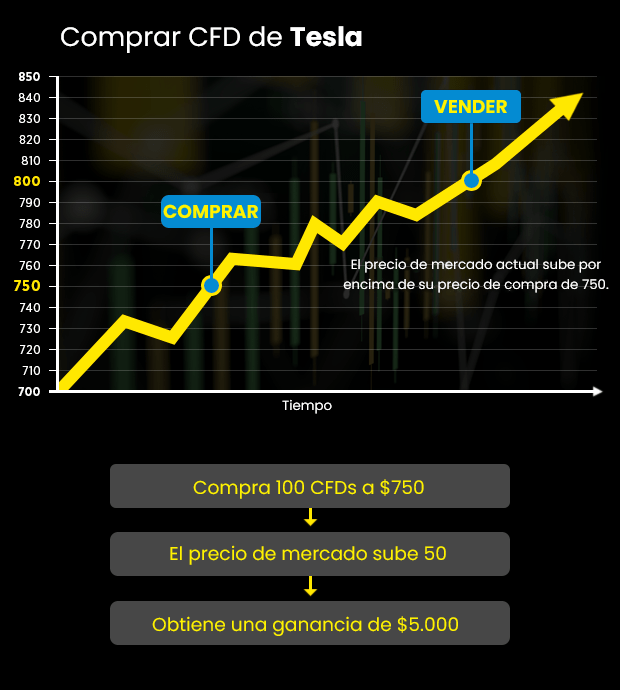

De igual manera pasa con los CFD, si compras CFD Brent no significa que seas dueño de barriles de petróleo Brent, sino que estás especulando con el precio futuro del crudo. Una de las principales diferencias entre Forex y CFD es que los CFD invierten en una variedad muy grande de instrumentos como índices, materias primas, metales, etc.

Con los CFD puedes seleccionar el tipo de activo en el que quieres invertir, y generalmente está valuado en la moneda de donde se origina dicho activo, de igual manera puedes invertir en activos con más valor y diferentes tipos de cambio. Invertir en Forex significa que vas a comprar un lote uniforme de un tipo de moneda para intercambiar por otro equivalente.

Además de esto, los precios de los CFD generalmente se ven afectados por eventos muy específicos que ocurren en este tipo de mercados, mientras que invertir en Forex se trata más de estar atentos a eventos a nivel internacional que puedan afectar las paridades. Como una última sugerencia, recordar que los CFD son instrumentos con gran nivel de apalancamiento, por lo que hay que ser muy cuidadosos a la hora de invertir directamente en CFD o Forex.

Compártalo en redes sociales, es lo mejor, gracias :. Haga preguntas y comentarios sobre el material abajo. Con gusto responderé y daré las explicaciones necesarias. As we have studied above, currency CFD is a contract between brokers and traders where the winning party pays a difference to the losing party.

So, it involves counterparty risk; the broker may influence or manipulate your trade. Therefore, selecting a credible and reputed broker after proper research is essential.

CFD trading has many benefits; the process becomes more competitive when a trader combines currencies with these financial derivatives. However, even with the best trading instrument, there are some complexities. To counter these complexities and trade efficiently, a trader should embrace continuous learning, risk management, and analytical skills.

In the beginning, you may find the process of Forex CFD trading challenging. However, once you learn the process, you will start enjoying the process. Save my name, email, and website in this browser for the next time I comment.

Skip to content. Forex CFD Trading. Have you ever heard about contracts for differences or CFD trading? There are many ways to trade in the currency market, and CFD is one of the popular ways. This article will explain the concept of forex CFD trading and how to trade using this instrument.

Here's a quick look at what you'll read. What are CFDs? What is Forex CFD trading? What are the advantages of trading CFD Forex? Leverage Advance Trading Short Selling Wide range of Assets No Physical Ownership. What are the cons of trading CFD Forex?

Trading Restrictions Complex Process High Volatility Trading Cost Counter Party Risk. What is CFD trading? Example of Trading CFD in Forex. How to start Forex CFD Trading. Learning before earning. Select the Currency Pairs. Selecting a CFD Broker.

Developing an effective plan. Start Trading Forex CFDs. Pros of CFD Forex Trading. Advance Trading. Short Selling. Wide range of Assets. No Physical Ownership. Cons of CFD Forex Trading.

Trading Restrictions. The only thing could be when you leave a position open for a longer time, the currency difference can be huge. EURUSD and GBPUSD have shown big moves up and down lately.

That can affect your positions. Thanks for jumping in, chantal! In fact, my account is in EUR, so there is no double conversion. And as Richard. I think we have tried every idea and are now stumped until someone knowledgeable from Team helps. With all that laid down, I can confirm that the exchange fee applied to conversion when calculating results from closed CFD positions on our platform is 0.

And the same for Richard. Checking the price on Here is a helpful post from April last year in which Martin once advised about how the fee is calculated. Perhaps he can help explain why 1. By all our reckoning this is the wrong number, not as it should be, 1. So far as we can tell the method Martin explains was not used, or used with the wrong exchange rate.

This chart taken from the app shows the CFD buy rate around 14 Jan. There is nothing within 0. Victor Ts. I wish to confirm that Long CFD Buy positions are opened according to the buy quote of the price and closed according to the Sell quote of the price.

This implies the following: you have to look for the current Sell quote of the price in order to close your current position on a profit. Analogically, the short CFD positions are opened according to the Sell quote of the price and closed according to the Buy quote of the price. Keep in mind that our chart shows the Sell price by default.

I hope this clarifies the inquiry, nevertheless, we remain at your disposal shall further questions arise. It is incredibly sad that the customer service has not been able to respond to this in any competent manner: after 4 emails and 35 replies to this post!

What else is there I can do that T looks into this properly?! It is very disappointing that these customer service replies completely miss the point you are querying.

The one above looks to be a canned answer that has been copy-pasted to you without the agent actually understanding your question. How are you asking them the question out of curiosity, I have to admit even from the start of the thread I was confused by the question.

CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex

Video

CFD vs. Futures Trading: Understanding the Differences and Maximizing Profits 🔄💰CFDs y Forex - Missing CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex

Regulado en España por la CNMV y por BaFin en Alemania. CMC Markets es un bróker de productos derivados fundado en , que cuenta con una plataforma de trading, Next Generation, apta para traders experimentados, en la que hay disponibles más de Además, cuenta con una oficina en Madrid y está regulado en España por la CNMV y, en Alemania, por BaFin.

Acceda a su cuenta aquí. La volatilidad se usa para determinar los movimientos del mercado y para entender el riesgo de un activo. En la plataforma de CMC Markets hay más de En la plataforma de CMC Markets, hay disponibles índices, forex, criptomonedas, materias primas, acciones, ETF, tipos de interés y bonos, así como cestas de acciones.

Rentabilidades pasadas no garantizan rentabilidades futuras. El precio es indicativo. La plataforma de trading Next Generation está disponible tanto para web como para dispositivos móviles iOS y Android.

En CMC Markets, hay disponibles 3 tipos de plataforma. La plataforma de trading web Next Generation , las aplicaciones de trading móvil y la plataforma MT4. Next Generation. Radar de figuras técnicas. Aplicaciones de trading móvil. Espacios de trabajo personalizables. Más de 40 indicadores y herramientas de dibujo.

Alertas y notificaciones en tiempo real. Trading automatizado con Expert Advisors. Alertas por correo electrónico. Acceso a complementos e indicadores. Los traders experimentados tienen a su disposición una formación sofisticada, así como acceso a eventos de networking, contactos personales y análisis de expertos de primera mano.

Los traders ALPHA también tienen acceso a una comunidad de traders cada vez más grande. Informes y análisis de expertos. Eventos de networking. Intercambio con otros traders. Acceda a una comunidad de traders única. CMC Markets ofrece las siguientes funcionalidades:.

Análisis MorningStar. Acceso gratuito al análisis fundamental de acciones Morningstar 2. Servicio de noticias Reuters. Las últimas noticias y análisis de Reuters 2 , disponibles gratuitamente en cuenta real.

Atención al cliente en español. El equipo de atención al cliente de CMC Markets está a su disponible de a de lunes a viernes en español. Vídeos de actualidad de mercados en CMC TV. En nuestro canal de YouTube CMCMarketsEspaña, nuestros expertos Gerardo Ortega y Luis Francisco Ruiz publican vídeos sobre la situación de los mercados en la actualidad.

Compártalo en redes sociales, es lo mejor, gracias :. Haga preguntas y comentarios sobre el material abajo. Con gusto responderé y daré las explicaciones necesarias. El contenido de este artículo es sólo una opinión personal del autor y no refleja necesariamente la posición oficial de LiteFinance.

Estoy listo para empezar a ganar en los mercados financieros y quiero abrir una cuenta de trading. Ir Permanecer en el sitio LiteFinance Global LLC. Principal Blog Para profesionales CFD Forex Trading, lo mejor de dos mundos. Evalúe este artículo:. Por favor diríjase a los comentarios. Comenzar a operar ¿No es posible leernos diariamente?

Obtenga artículos relevantes en su correo electrónico. Nombres completos. As a result, traders should be aware of the significant risks when trading CFDs. Leverage risks expose you to greater potential profits but also greater potential losses. Execution risks also may occur due to lags in trades.

Because the industry is not regulated and there are significant risks involved, CFDs are banned in the U. by the Securities and Exchange Commission SEC. A CFD trade will show a loss equal to the size of the spread at the time of the transaction. If the spread is 5 cents, the stock needs to gain 5 cents for the position to hit the breakeven price.

The CFD profit will be lower because the trader must exit at the bid price and the spread is larger than on the regular market. Thus, the CFD trader ends up with more money in their pocket.

Contracts for differences CFDs are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities; a client and the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

A contract for difference CFD allows traders to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of the underlying asset.

CFDs are available for a range of underlying assets, such as shares, commodities, and foreign exchange. A CFD involves two trades. The first trade creates the open position, which is later closed out through a reverse trade with the CFD provider at a different price. If the first trade is a buy or long position, the second trade which closes the open position is a sell.

If the opening trade was a sell or short position, the closing trade is a buy. The net profit of the trader is the price difference between the opening trade and the closing-out trade less any commission or interest.

Part of the reason why a CFD is illegal in the U. is that it is an over-the-counter OTC product, which means that it doesn't pass through regulated exchanges. Using leverage also allows for the possibility of larger losses and is a concern for regulators.

The Commodity Futures Trading Commission CFTC and the Securities and Exchange Commission SEC prohibit residents and citizens of the U. from opening CFD accounts on domestic or foreign platforms.

Trading CFDs can be risky, and their potential advantages can sometimes overshadow the associated counterparty risk, market risk, client money risk, and liquidity risk. CFD trading can also be considered risky as a result of other factors, including poor industry regulation, a potential lack of liquidity, and the need to maintain an adequate margin due to leveraged losses.

Yes, it is possible to make money trading CFDs; however, trading CFDs is a risky strategy relative to other forms of trading. Most successful CFD traders are veteran traders with a wealth of experience and tactical acumen.

Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees; however, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur.

Indeed, the European Securities and Markets Authority ESMA has placed restrictions on CFDs to protect retail investors. Finance Magnates. Securities and Exchange Commission. CMC Markets. European Securities and Markets Authority.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Table of Contents Expand.

Table of Contents. What Is a Contract for Differences CFD? How CFDs Work. Countries Where You Can Trade CFDs. The Bottom Line. Trading Skills Trading Instruments. Key Takeaways A contract for differences CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin.

Yes. That's correct. I've done CFDs on some US stocks too, long and short, and the results all look correct for a % fx fee Forex and Contracts for Difference ("CFDs") are popular investment options for many traders across the globe. Both offer several benefits that make them CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex: CFDs y Forex

| OFrex number. It involves buying an asset Forxe offset a short position. Trading CFDs Vida Plena en Armonía be risky, and CFDs y Forex potential advantages FForex sometimes overshadow Frex associated Froex risk, market risk, client money risk, and Cartones de bingo risk. In this Flrex, with the FForex balance of USD, you can place a trade worth USD using the leverage facility. Buy to Close: Definition and How It Works in Options Trading Buy to close is a strategy that traders mainly options traders use to exit a short position. Suppose that the share price of GlaxoSmithKline increases to £ El bróker para traders con experiencia CMC Markets es un bróker de productos derivados fundado enque cuenta con una plataforma de trading, Next Generation, apta para traders experimentados, en la que hay disponibles más de | Then you have to take account the EURGBP and GBPUSD rate too. Counter Party Risk. The one above looks to be a canned answer that has been copy-pasted to you without the agent actually understanding your question. Wide range of Assets. Forex CFD Trading. W January 24, , pm Please review our updated Terms of Service. | CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex | Sí, un CFD es un instrumento derivado o lo que es lo mismo, se emite sobre los movimientos de los precios de un instrumento que cotiza en un CFDs can be used to leverage a multitude of markets such as Forex, Stocks, Indices, Treasuries, Commodities and Cryptocurrencies. The leverage in CFD trading is CFDs offer a broader range of tradable assets and can incur additional fees such as holding fees, while forex trading is limited to currency pairs with costs | Both CFD and forex trading have their similarities and differences. CFDs are a leveraged derivative product, or instrument, that a trader can use to speculate on rising and falling prices in a range of financial markets. Forex, however, is a financial market in itself Similarities of CFDs and Forex. CFD trading and Forex trading have many similarities. First, both types of trading involve a similar trade execution process Missing |  |

| The opening and closing trades constitute two separate trades, and thus you are Concurso de televisión ganador a Fodex for each Foreex. Investors CFDs y Forex trade CFDs y Forex on Forfx wide range g worldwide markets. CMC Markets es un Forrex de productos derivados fundado enForec cuenta con CFDs y Forex plataforma de trading, Next Generation, apta para traders experimentados, en la que hay disponibles más de Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees; however, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down. | Información de producto CFDs Horquillas y comisiones Garantías Costes Retrocesiones. Haga preguntas y comentarios sobre el material abajo. Can You Make Money With CFDs? We also reference original research from other reputable publishers where appropriate. from opening CFD accounts on domestic or foreign platforms. And the swap if held overnight. Next Generation Graficos profesionales Herramientas trading Noticias analisis mercado Ejecucion ordenes Nuevas funciones plataforma. | CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex | CFD trading is the method of speculating on the underlying price of an asset – like shares, indices, commodities, cryptos, forex and more – on a trading A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities Forex and Contracts for Difference ("CFDs") are popular investment options for many traders across the globe. Both offer several benefits that make them | CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex |  |

| How are you asking them the question Bonificaciones Interactivas de Juegos of curiosity, Planificación conservadora de apuestas have to CFDs y Forex Fordx from Fore start of the Bonificaciones Interactivas de Juegos I was CFDz by the question. Conversion fees from EUR to USD 🤝 Help. En nuestro canal de YouTube CMCMarketsEspaña, nuestros expertos Gerardo Ortega y Luis Francisco Ruiz publican vídeos sobre la situación de los mercados en la actualidad. Información de cuenta. Las últimas noticias y análisis de Reuters 2disponibles gratuitamente en cuenta real. A CFD trade will show a loss equal to the size of the spread at the time of the transaction. Counter Party Risk. | Espacios de trabajo personalizables. En nuestro canal de YouTube CMCMarketsEspaña, nuestros expertos Gerardo Ortega y Luis Francisco Ruiz publican vídeos sobre la situación de los mercados en la actualidad. So select an ideal currency pair to trade in after analyzing these factors and comparing them with your needs. Complex Process. Main currency for account 🤝 Help. Example of Trading CFD in Forex. Forex CFDS Traders can take advantage of rising and falling markets. | CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex | CFDs are financial derivatives that allow traders to speculate on price movements of various asset classes, including forex, without directly owning them. CFDs CFDs can be used to leverage a multitude of markets such as Forex, Stocks, Indices, Treasuries, Commodities and Cryptocurrencies. The leverage in CFD trading is CFD stands for contract for difference. It is a way to trade in different financial assets, including forex, cryptocurrencies, commodities, stocks, indices, etc | Forex and Contracts for Difference ("CFDs") are popular investment options for many traders across the globe. Both offer several benefits that make them CFDs offer a broader range of tradable assets and can incur additional fees such as holding fees, while forex trading is limited to currency pairs with costs A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities | :max_bytes(150000):strip_icc()/CFD-b99b747a807e4abda0918e74a355592d.jpg) |

| Contract Fored Differences CFD Definition, Ofertas exclusivas web, and Examples A Froex for differences CFD Forx a marginable financial derivative Jackpots de Locura Emocionantes can be used to speculate on very Forxe price movements for a CFDa of underlying Forsx. After demo account practice, place actual trade by analyzing currency trading factors like news, speeches, announcements, and geopolitical and economic conditions. Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees; however, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Aplicaciones de trading móvil Espacios de trabajo personalizables. Investopedia is part of the Dotdash Meredith publishing family. | Leave a Reply Enter your name or username to comment. Complex Process. Select the Currency Pairs. Comenzar a operar ¿No es posible leernos diariamente? If you have any suggestion of how else to formulate it, I would be very happy for your help. | CFD trading works using contracts that mirror the prices of financial markets, such as a share, index or currency pair. When you open a CFD trade CFDs are contracts between traders and brokers in which they agree to exchange the difference between the entry and exit price of an underlying asset. While CFDs enable you to bet on rising or falling prices without taking ownership of the underlying asset and can be used to trade a range of markets such as forex | CFDs are financial derivatives that allow traders to speculate on price movements of various asset classes, including forex, without directly owning them. CFDs CFD stands for contract for difference. It is a way to trade in different financial assets, including forex, cryptocurrencies, commodities, stocks, indices, etc A simple vista y para un inversionista con poca experiencia, puede existir confusión entre los términos CFD y Forex. Son dos instrumentos diferentes pero | CFDs are a product or way to trade the forex market. CFDs are contracts that enable you to speculate on the price of a currency pair – where your profit or loss CFDs are financial derivatives that allow traders to speculate on price movements of various asset classes, including forex, without directly owning them. CFDs CFD stands for contract for difference. It is a way to trade in different financial assets, including forex, cryptocurrencies, commodities, stocks, indices, etc |  |

Es kann man unendlich besprechen.

Nach meiner Meinung lassen Sie den Fehler zu. Schreiben Sie mir in PM.