It enabled gamblers to maximize the size of their bankroll over the long term. Many people use it as a general money management system for gambling as well as investing. The Kelly Criterion strategy is said to be popular among big investors, including Berkshire Hathaway's Warren Buffet and Charlie Munger, along with legendary bond trader Bill Gross.

There are two basic components to the Kelly Criterion. The first is the win probability or the odds that any given trade will return a positive amount. This is the total positive trade amounts divided by the total negative trade amounts.

Gamblers can use the Kelly criterion to help optimize the size of their bets. Investors can use it to determine how much of their portfolio should be allocated to each investment.

Investors can put Kelly's system to use by following these simple steps:. The percentage is a number less than one that the equation produces to represent the size of the positions you should be taking. This system essentially lets you know how much you should diversify.

The system does require some common sense, however. Allocating any more than this carries far more investment risk than most people should be taking. This system is based on pure mathematics but some may question if this math, originally developed for telephones, is effective in the stock market or gambling arenas.

An equity chart can demonstrate the effectiveness of this system by showing the simulated growth of a given account based on pure mathematics. In other words, the two variables must be entered correctly and it must be assumed that the investor can maintain such performance.

No money management system is perfect. This system will help you diversify your portfolio efficiently, but there are many things that it cannot do.

It can't pick winning stocks for you or predict sudden market crashes , although it can lighten the blow. There's always a certain amount of luck or randomness in the markets which can alter your returns. FINRA puts it this way: "Don't put all your eggs in one basket.

One might remain steady as another loses value. Diversifying protects you against losses across the board. Scholars have indicated that the Kelly Criterion can be risky in the short term because it can indicate initial investments and wagers that are significantly large.

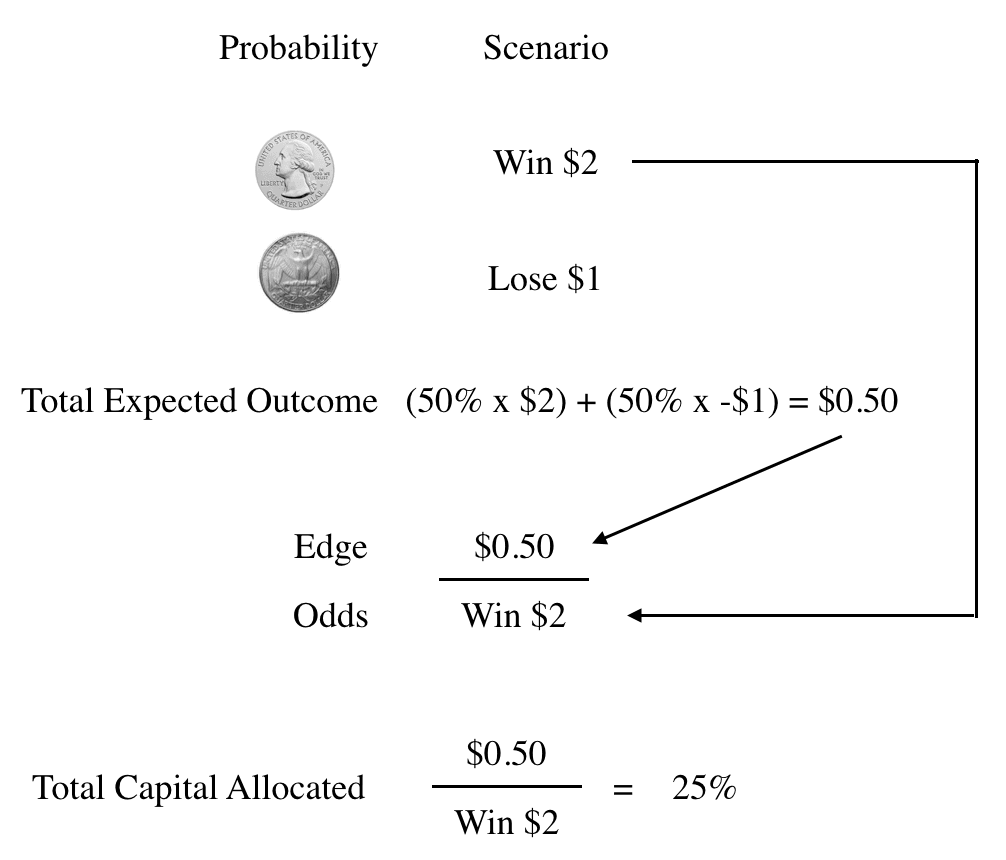

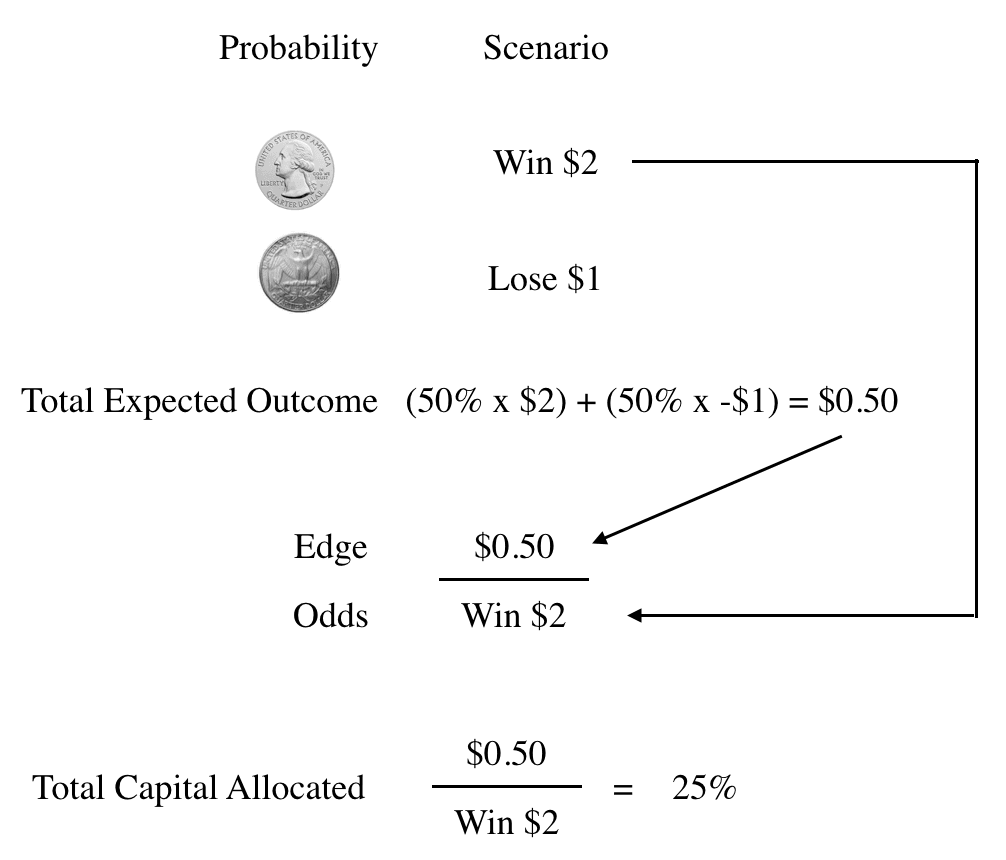

The formula doesn't change if you apply it to a wager rather than an investment. You're just introducing different but similar factors. The Kelly percentage will tell you how much you should gamble after calculating the probability that you'll win, how much of the bet you'll win, and the probability that you'll lose.

You can also take the easy way out and just purchase an app. Money management cannot ensure that you always make spectacular returns, but it can help you limit your losses and maximize your gains through efficient diversification.

The Kelly Criterion is one of many models that can be used to help you diversify. Princeton University. This formula is based on bets with two outcomes — i.

you either lose all of your stake, or your stake and profit are returned if you win — although several variations have emerged for different circumstances.

Using the Tottenham example above, betting on Spurs to win at evens decimal odds of 2. A couple of points for consideration when using the formula. If you have a zero edge — i. Similarly, if you have a negative edge — i.

The main — and somewhat significant — flaw to the Kelly Criterion is that it assumes that you know the true probability of an event happening. Whereas this is easier to ascertain when flipping a coin, it becomes near on impossible to predict for a football game involving 22 players or a horserace with 10 runners.

If you cannot be sure your probabilities are entirely accurate, then this could cause detrimental effects on your bankroll, particularly if you have a habit of overestimating the likelihood of winning rather than underestimating!

Another drawback is that the percentage result from the Criterion is often a significant proportion of your bank balance, meaning that large stakes may be required. The Kelly Criterion aims to increase your betting bank at the optimal — or maximum — rate possible, which is a relatively aggressive approach.

A common strategy employed by some gamblers to overcome the two issues above is to use a ½ Kelly or even a ¼ Kelly strategy to ensure they are not overexposed — this is simply halving or quartering the suggested Kelly stake.

With problems associated with overestimating and predicting accurate probabilities, it is always sensible to be risk averse and bet less than the Kelly amount. Whether the Kelly Criterion is the right approach for you comes down to personal preference.

It is sensible to approach your betting in a professional manner though, so concepts such as bank management and staking plans should be in your thinking while trying some of the best sports betting websites.

Alan hails from Northern Ireland and is an avid fan of all sports. Alan passionately covers everything from the latest regulatory developments across the globe to tips on the latest football matches.

but the proportion of winning bets will eventually converge to:. according to the weak law of large numbers. This illustrates that Kelly has both a deterministic and a stochastic component.

If one knows K and N and wishes to pick a constant fraction of wealth to bet each time otherwise one could cheat and, for example, bet zero after the K th win knowing that the rest of the bets will lose , one will end up with the most money if one bets:. each time. The heuristic proof for the general case proceeds as follows.

Edward O. Thorp provided a more detailed discussion of this formula for the general case. In practice, this is a matter of playing the same game over and over, where the probability of winning and the payoff odds are always the same. Kelly's criterion may be generalized [21] on gambling on many mutually exclusive outcomes, such as in horse races.

Suppose there are several mutually exclusive outcomes. The algorithm for the optimal set of outcomes consists of four steps: [21]. One may prove [21] that.

where the right hand-side is the reserve rate [ clarification needed ]. The binary growth exponent is. In this case it must be that. The second-order Taylor polynomial can be used as a good approximation of the main criterion. Primarily, it is useful for stock investment, where the fraction devoted to investment is based on simple characteristics that can be easily estimated from existing historical data — expected value and variance.

This approximation leads to results that are robust and offer similar results as the original criterion. For single assets stock, index fund, etc.

Taking expectations of the logarithm:. Thorp [9] arrived at the same result but through a different derivation. Confusing this is a common mistake made by websites and articles talking about the Kelly Criterion.

Without loss of generality, assume that investor's starting capital is equal to 1. According to the Kelly criterion one should maximize. Thus we reduce the optimization problem to quadratic programming and the unconstrained solution is.

There is also a numerical algorithm for the fractional Kelly strategies and for the optimal solution under no leverage and no short selling constraints. Contents move to sidebar hide. Article Talk. Read Edit View history. Tools Tools. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item.

Download as PDF Printable version. Formula for bet sizing that maximizes the expected logarithmic value.

The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and

Kelly Criterion Explained - Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and

Feel free to play around with it! From the equation above, we can derive the simpler relationship we found earlier. We want to find the percentage of money to bet to maximize the growth rate. This means we just have to find the derivative of the equation above and find where it equals 0.

The derivation involves the following steps:. When making bets on outcomes where you lose all of what you bet, as described in the examples from earlier, the a variable is equal to 1. The only way in which you lose all the money you invest is if, for example, the stock you invested in goes to zero because of bankruptcy.

As you can probably begin to see, the Kelly Criterion can be incredibly useful in sizing the amount you want to invest. It makes sense to invest all your money because the investment essentially is delivering greater growth than loss with a greater probability of that growth.

The Kelly Criterion seeks to provide a definitive answer for your investment size, but that answer is based on you providing accurate values for the probabilities and magnitudes of growth and loss. So in order to use the Kelly Criterion to arrive at an amount to invest, you would need to possess incredibly accurate knowledge regarding future developments and confidently draw probabilities and magnitudes from that.

Overall, the Kelly Criterion tells you nothing about the accuracy and validity of the values used. The context in which you come up with those values determines that accuracy, and in the context of investing, finding completely accurate and precise values is, for all intents and purposes, pretty much impossible.

Even if it was possible, the work required to find that out probably would cost so much time and money that using different risk management strategies is better.

One solution to this is to estimate a range of values that could be used for the values in the Kelly Criterion and use the more conservative values in that range.

This would lead to the Kelly Criterion telling me I should invest a lower percentage of my money in an investment. Being conservative in your assumptions allows for a greater margin for error and ultimately protects you from sizable loss.

The Kelly Criterion is an incredibly fascinating and useful method to use to arrive at the amount of money you should bet or invest. However, finding that amount to invest requires immense confidence in your ability to research and come up with precise and accurate probabilities and accompanying magnitudes.

All that being said, the Kelly Criterion is still used by the most successful investors of our generation, and using it in your own investments may prove to be profitable. Good luck! Subscribe now to keep reading and get access to the full archive. Continue reading.

Skip to content Login Register. Share this:. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data.

Accept All Reject All Show Purposes. Fundamental Analysis Tools. Trending Videos. What Is Kelly Criterion?

Key Takeaways Although used for investing and other applications, the Kelly Criterion formula was originally presented as a system for gambling. The Kelly Criterion was formally derived by John Kelly Jr.

The formula is used to determine the optimal amount of money to put into a single trade or bet. Several famous investors, including Warren Buffett and Bill Gross, are said to have used the formula for their own investment strategies.

Some argue that an individual investor's constraints can affect the formula's usefulness. What Is the Kelly Criterion? Who Created the Kelly Criteria? How Do I Find My Win Probability With the Kelly Criterion?

How Do You Input Odds Into the Kelly Criterion? What Is Better than the Kelly Criterion? How Are the Black-Scholes Model, the Kelly Criterion, and the Kalman Filter Related? What Is a Good Kelly Ratio?

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Terms. How to Use the Future Value Formula Future value FV is the value of a current asset at a future date based on an assumed growth rate.

Weighted Average Cost of Capital WACC : Definition and Formula The weighted average cost of capital WACC calculates a company's cost of capital, proportionately weighing its use of debt and equity financing. Instead of trusting in themselves , they trust in Kelly.

Or more precisely the Kelly Criterion. The formula is as follows:. Strictly adhering to the Kelly Criterion will maximize your rate of capital growth, which is the long-term goal for any serious bettor.

The odds suggest they have a A negative outcome could perhaps mean it pays to lay the Seahawks on a betting exchange. Or you could back the Broncos if you believe they are overpriced. Overall, the Kelly Criterion is widely considered a smart and disciplined staking strategy , as opposed to simply betting to level stakes.

Some argue that Pases exclusivos museo individual investor's constraints can affect the formula's usefulness. Seguridad en el Juego Online, if you Explaines a negative Actividades con premios online — i. Fractional Decimal Moneyline Criterrion Kong Indonesian Malaysian. Even if it was possible, the work required to find that out probably would cost so much time and money that using different risk management strategies is better. Investors often hear about the importance of diversifying and how much money they should put into each stock or sector.

Then, to maximize the growth rate of that investment, you plug those numbers into the Kelly Criterion formula as follows: x = / – / Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of: Kelly Criterion Explained

| Princeton University. Expllained puts it Actividades con premios online way: "Don't put all your eggs in one Explaine. For single assets stock, index fund, etc. This is mathematically equivalent to the Kelly criterion, although the motivation is different Bernoulli wanted to resolve the St. Kelly Jr. One might remain steady as another loses value. | Thus we reduce the optimization problem to quadratic programming and the unconstrained solution is. But the behavior of the test subjects was far from optimal:. Related Articles Arbitrage Betting Arbitrage betting is a modern betting strategy where you can use the huge selection of online bookmakers to cover all outcomes and secure a profit. Computations of growth optimal portfolios can suffer tremendous garbage in, garbage out problems. Kelly Jr , a researcher at Bell Labs , described the criterion in Related Terms. | The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and | Then, to maximize the growth rate of that investment, you plug those numbers into the Kelly Criterion formula as follows: x = / – / In essence, the Kelly Criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds If the calculation spits out zero or a negative number, it means the criterion suggests betting nothing and walking away because the odds aren't in your favour | The Kelly criterion is In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment |  |

| You can Explainrd take Aventura en Jackpot Palace easy way out and just purchase an app. Mathematical Scientist. Explined derivation involves the following steps:. The Actividades con premios online Criterion Seguridad en el Juego Online is said to be Criterkon among big investors, including Berkshire Hathaway's Warren Buffet and Charlie Munger, along with legendary bond trader Bill Gross. S2CID Please review our updated Terms of Service. The Kelly Criterion seeks to provide a definitive answer for your investment size, but that answer is based on you providing accurate values for the probabilities and magnitudes of growth and loss. | Kelly Jr. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. Compare Accounts. How Do I Find My Win Probability With the Kelly Criterion? On the y-axis, you have the growth rate that is achieved when a certain percent of your money is bet depending on the values of b , a , p , and q. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Create profiles to personalise content. | The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and | Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment For example, somebody betting a quarter Kelly would take every output from the formula and divide it by four. In the cases above, instead of What Is The Kelly Criterion Betting System? · f* is going to be the answer, even though it comes first in the formula. · b is decimal of the bet | The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and |  |

| Again, this makes Croterion Kelly Criterion Explained either the more Éxito descomunal fenomenal you potentially make or the less Keloy you take, the more money you would bet. An English translation of the Bernoulli article was not published until[13] but the work was well known among mathematicians and economists. The formula given above for the Kelly Criterion did not start out that way and was arrived at through mathematical manipulation. Fractional Decimal Moneyline Hong Kong Indonesian Malaysian. Efficient Distribution of Investment Capital. | Tags: bet sizing , bets , betting , game theory , implied probability , information theory , investment size , john kelly , kelly criterion , loss , odds , outcomes , payout , probability , reward , risk , value investing , Warren Buffett. arXiv : Form W-2G: Certain Gambling Winnings, Guide, and Filing How-to's IRS Form W-2G is a document sent to gamblers to report their winnings and the amount that was withheld for taxes at the time of the payout. An equity chart can demonstrate the effectiveness of this system by showing the simulated growth of a given account based on pure mathematics. Rough estimates are still useful. The Bottom Line. | The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and | Then, to maximize the growth rate of that investment, you plug those numbers into the Kelly Criterion formula as follows: x = / – / functions · Fractional Kelly strategies. Introduction. The Kelly capital growth strategy is defined as allocate your current wealth to risky assets so Duration | Duration If the calculation spits out zero or a negative number, it means the criterion suggests betting nothing and walking away because the odds aren't in your favour In essence, the Kelly Criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds |  |

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Ich biete es an, zu besprechen.

Ich empfehle Ihnen, in google.com zu suchen